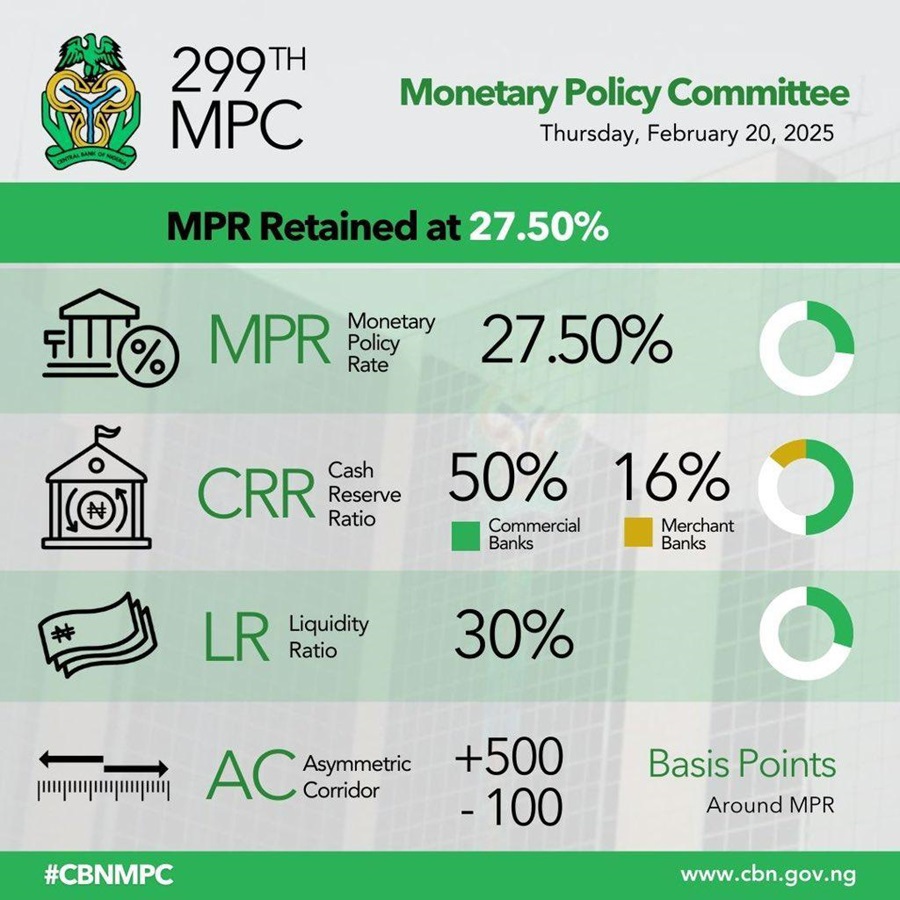

February 20, (THEWILL) – The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has retained the benchmark interest rate at 27.50%.

At the last 298th MPC meeting held on November 25 and 26, 2024, the apex bank had raised the monetary policy rate (MPR), which benchmarks interest rates, from 27.25% to 27.50%– an increase of 25 basis points, emphasising concerns over core inflation, money supply growth, fiscal deficits, and food price pressures.

Speaking on Wednesday, at the end of the 299th MPC meeting in Abuja, the CBN Governor, Olayemi Cardoso, said the committee was unanimous in its decision to hold rates at current levels.

He said, “The committee was unanimous in its decision to hold all parameters and thus decided as follows: retain the MPR at 27.50%, retain the asymmetric corridor around the MPR at plus 500 to minus 100 basis points. Retain the cash reserve ratio of deposit money banks at 50% and merchant banks at 16% and retain the liquidity ratio at 30%.”

The retention, however, came amid a deceleration in inflation in January.

THEWILL reports that the National Bureau of Statistics (NBS) had reported on Tuesday that Nigeria’s headline inflation dropped from 34.80 percent in December 2024 to 24.48 percent in January 2025. The Bureau also said food inflation stood at 26.08 percent year-on-year in January, a decrease in the food index compared to the 39.84 percent year-over-year figure recorded in the previous month.

The MPC is the highest policy-making committee of the CBN, set up to review economic and financial conditions in the economy and determine the appropriate stance of policy in the short to medium term. The committee is also in charge of examining the CBN’s monetary policy framework and making any necessary revisions.

The benchmark interest rate, also called monetary policy rate (MPR), determines the cost of borrowing in the economy. It can be considered the interest rate the CBN uses to lend to banks who then lend to customers at a higher rate.